Or are the issues I cited about the quadratic just negligible in practice? Not aware of a clean portfolio optimisation theory under more realistic assumptions. For example, a mean-variance investor could refuse a gift of a limited liability asset, if it's volatile enough. That's complicated.Īre there no other simple, more realistic functional forms for utility that would still lead to a reasonably clean portfolio optimization theory? Impose joint conditions on both the expected utility function and the distribution of $W$. Those can have a restricted domain (ie limited liability, though then also limited upside, if I'm not mistaken). It can be shown that one can express the above as a function of only $\mu, \sigma$ for elliptical distributions, no matter what $U$ is chosen.

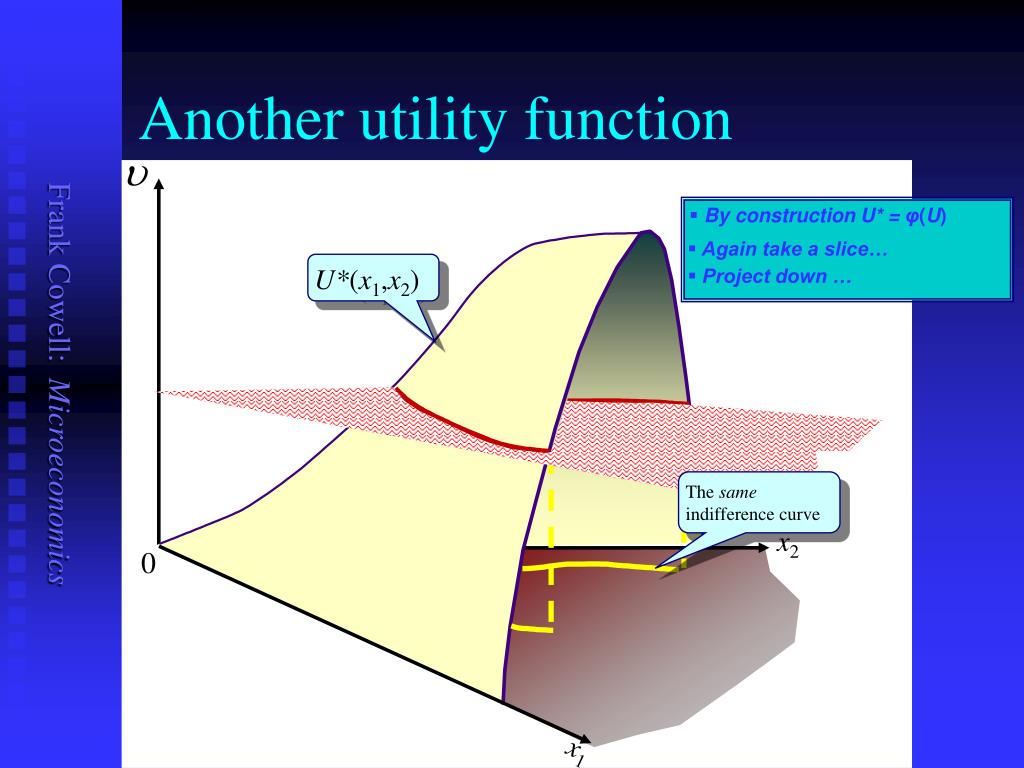

Impose conditions on the returns, ie the distribution of $W$. That is the idea with quadratic utility (which, as you point out, has many problems). Impose conditions on the utility function: Take an expected utility function $U$ whose higher derivatives (above second derivative) vanish. Now, to turn this into a mean-variance utility (ie only a function of $\mu, \sigma$), there are 3 ways: Aidiff i i lAn indifference map is equivalent to a utility function each is the other. Curves The collection of all indifference curves for a given preference relationcurves for a given preference relation is an indifference map. Now, you can express the expected utility using its Taylor approximation around the expected wealth, with $\mu = E, \Delta = W - \mu$ (note that $E=0$): Utility Functions & Indiff CurvesUtility Functions & Indiff. This is an entirely different approach than expected utility maximisation. The CAPM is based on mean-variance utility: investors chose their portfolio based only on its mean and variance.

0 kommentar(er)

0 kommentar(er)